If you have a disability or you're aging and need help getting around, you may be considering using a wheelchair. Many people immediately assume their health insurance can and will pay for a wheelchair, but the reality is more complicated. This guide, written by a lifelong wheelchair user with contributions from other disabled experts in The Ability Toolbox community, can help you decide whether you should buy a wheelchair out-of-pocket or use insurance.

Assessing Your Needs and Situation

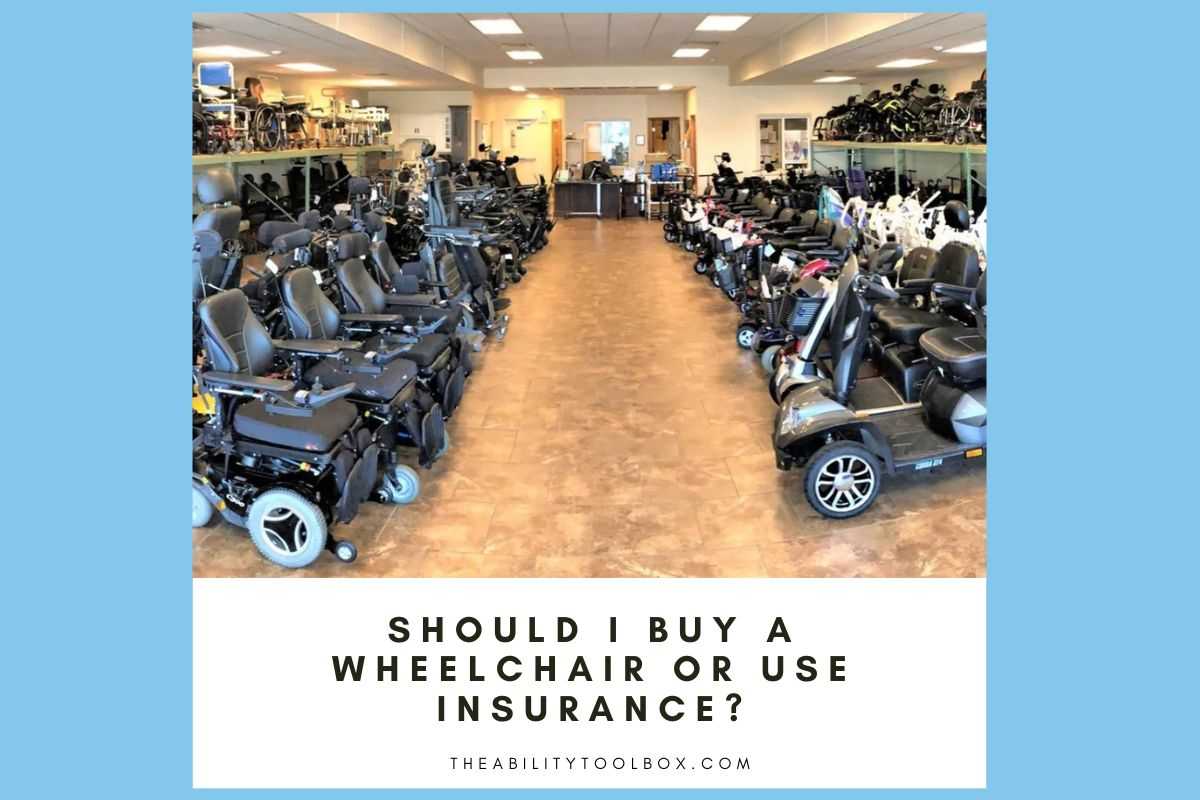

Before deciding whether to pay for a wheelchair yourself or use insurance, you should determine the type of wheelchair that best suits your mobility limitations and lifestyle. Do you need manual or electric? How portable does the device need to be — do you have an accessible vehicle or will it need to fit in a car trunk? Keep in mind that features such as tilt, recline, and seat elevation are only available on large, non-portable power wheelchairs which are very expensive and require an accessible vehicle for transport.

When to Consider Buying a Wheelchair Out of Pocket

The following are some circumstances where it can make more sense to private pay for a wheelchair rather than using insurance.

If you won’t be using a wheelchair very often, consider buying one.

If you don’t need to use a wheelchair much, a simple and low-cost chair will get the job done. You could even rent a wheelchair, although if you anticipate doing so fairly regularly, you’ll save money buying a new or used model.

If you need a basic manual or power wheelchair, you may save money buying it yourself.

If your insurance only covers 80% and you'd have to spend a lot of time and money on going to lots of medical appointments to get the funding authorized, you may actually pay less by just buying a wheelchair.

If you urgently need a wheelchair and can afford to buy one, you should.

As the saying goes, time is money. If you’re stuck at home or otherwise limited because you don’t have an adequate mobility device, you’re losing precious time you could spend with your loved ones, working, traveling, etc. You could also buy a cheap used or basic wheelchair to use temporarily while fighting insurance to get one that has all the features you need.

When to Use Health Insurance to Buy a Wheelchair

Sometimes insurance is the best or only option to get a wheelchair; here are some examples.

If you are on a fixed income, you'll probably need to use Medicare and/or Medicaid to get a wheelchair.

Basic mobility devices have become much more affordable, but may still be too costly if you're living under the poverty line. It can take some time, but if you have both Medicare and Medicaid, you should be able to get a good wheelchair that meets your needs for free.

If you need a custom or complex wheelchair, the cost may be prohibitive without insurance.

Devices such as complex rehabilitation technology power wheelchairs can cost $30-$50,000, so unless you're very wealthy, you'll probably need to use health insurance.

You may also consider a hybrid approach. Insurance may deny certain features on high-end devices, at which point you can seek out alternative funding sources or opt to private pay for just those items.

Learn more in our article: How to Get Health Insurance to Pay for an Electric Wheelchair

Tips for Buying a Wheelchair Fully or Partially Out-of-Pocket

If you're buying a wheelchair, you can still save a lot of money and time by planning ahead and making smart purchase decisions.

Get a prescription.

Even if you're paying for a wheelchair, you should still get a prescription from your doctor. Some DME providers may require it for some devices, and it will provide proof of a medical expense if you're deducting the cost from your countable income and/or taxes.

Use your health savings account.

You can use your HSA to pay for a wheelchair and other medical equipment. Most DME providers are familiar with HSAs and can assist you if needed.

Ask about financing options or use pay-in-four.

Some DME dealers offer financing with a low monthly payment. If you don't have good credit, many online sellers offer a pay-in-four option with no credit check required.

Deduct the cost of the wheelchair from your taxes.

Wheelchairs, even non-coded ones, are medical devices, so you can deduct the cost from your taxes as a medical expense. If you are on SSDI, SSI, and/or Medicaid, you can deduct the cost from your countable income for benefits purposes. If you work while on SSDI/SSI and need a wheelchair to perform activities of daily living or do your job, it can count as an Impairment-Related Work Expense.

Do you have tips for buying a wheelchair?

Share them with our disability community in the comments.

Founder and Editor-in-Chief of The Ability Toolbox. I received my BA in English from Stanford University and MA in Clinical Psychology from Antioch University Los Angeles, and have worked in entertainment and health media for over 20 years. I also blog about traveling with a disability. As a wheelchair user with cerebral palsy, I am deeply committed to amplifying the voices of the disability community through writing and advocacy.

Start the discussion at community.theabilitytoolbox.com